Rising Fraud Due to Coronavirus

Are you among the many of people that receive a call about your cars extended warranty?

At times it feels like they call multiple times a week! Just know you are not alone. That appears to be one of the tactics, among many others, that have increased since the coronavirus pandemic.

With an uncertain economy and an increased reliance on technology have opened the door to many opportunities that can lead to fraud. The Association of Certified Fraud Examiners (ACFE) have conducted a series of surveys exploring how the current environment is affecting fraud and anti-fraud programs.

The study showed the anti-fraud professionals saw an increase in nearly every category. The top categories being cyber fraud, unemployment fraud, and payment fraud. However, the categories that had the most growth were insurance fraud by 12%, loan and bank fraud by 11%, identity theft by 10%, and employee embezzlement by 9%.

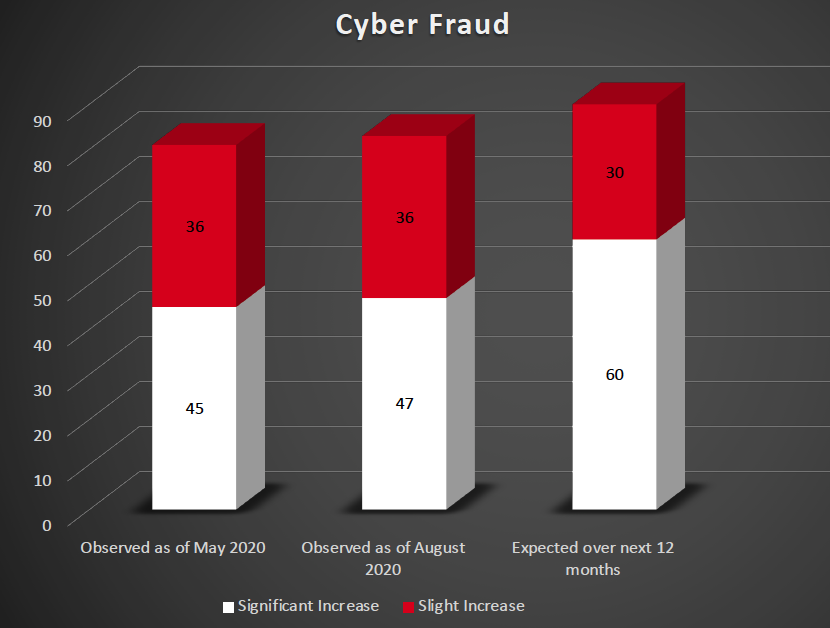

The biggest growth is perceived to be in Cyber Fraud with a whopping 83% increase and with anticipation that there will be an increase of 90% over the next 12 months.

Unemployment fraud was the next largest increase at 73% reported an increase.

PPP Loan Fraud

The survey done by the ACFE did not mention the Paycheck Protection Program specifically. However, the PPP Loan has in fact attracted fraudsters. 76% of fraud professionals expect to see an increase in bank and loan fraud, not just from the PPP loan, an overall increase is expected.

The federal government has been tracking what they can of PPP loan fraud. With nearly 500 people suspected of coronavirus related loan and bank fraud, 57 have currently been charged.

This has been a difficult time for so many people and businesses. It is best to step up as a manager and do your best to not cut corners. Protecting not only yourself but your business from fraud. Put faith in your accountants! They/we are here to keep an eye on your financials, making sure if there is an odd transaction that it can be resolved as soon as possible.

With the increased reliance on technology, the fear of a spike in fraud is inevitable. Individuals and business owners a like need to be away and cautious moving forward. Consult your accountant, be sure to dive in once you see a red flag rather than assuming it may be nothing.

09/15/2020