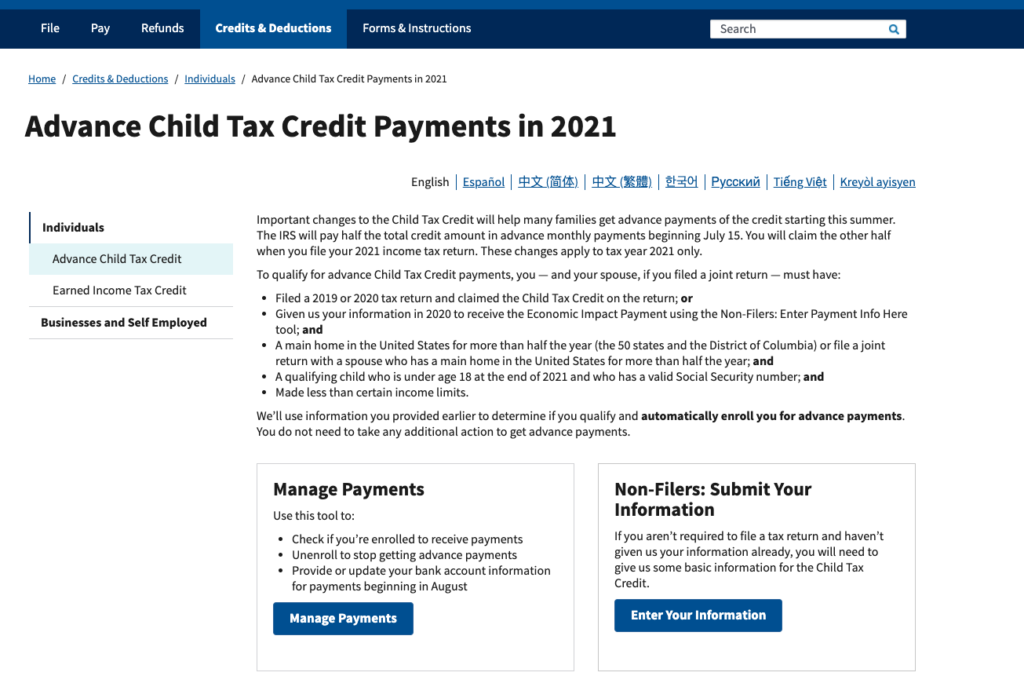

How-to Opt out of the Advance Child Tax Credit Payments

Resources

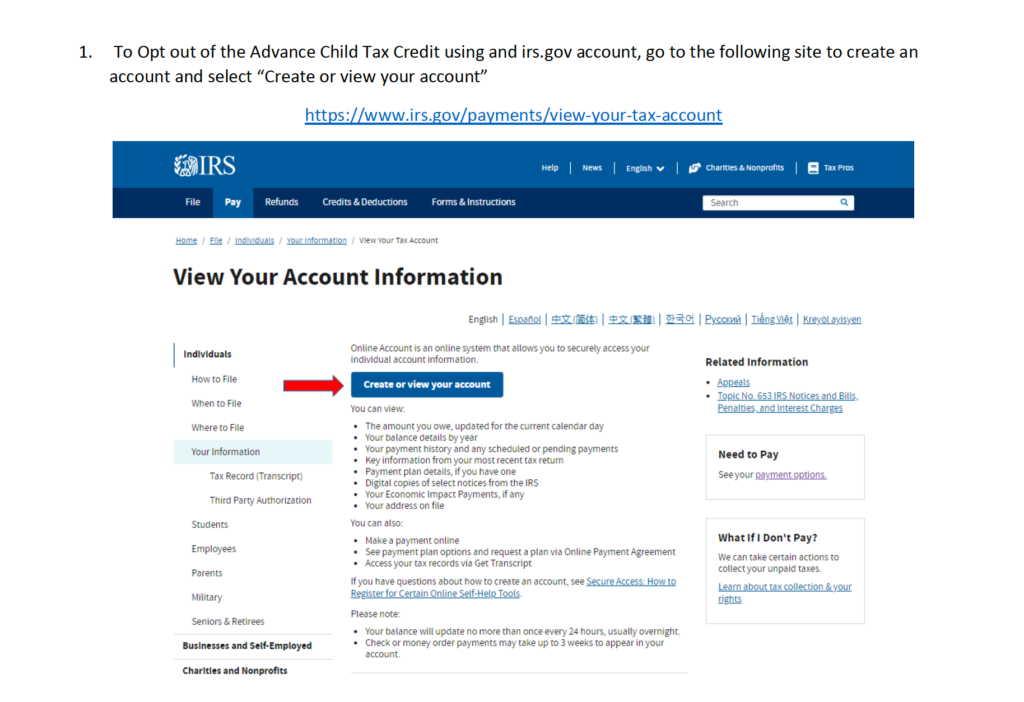

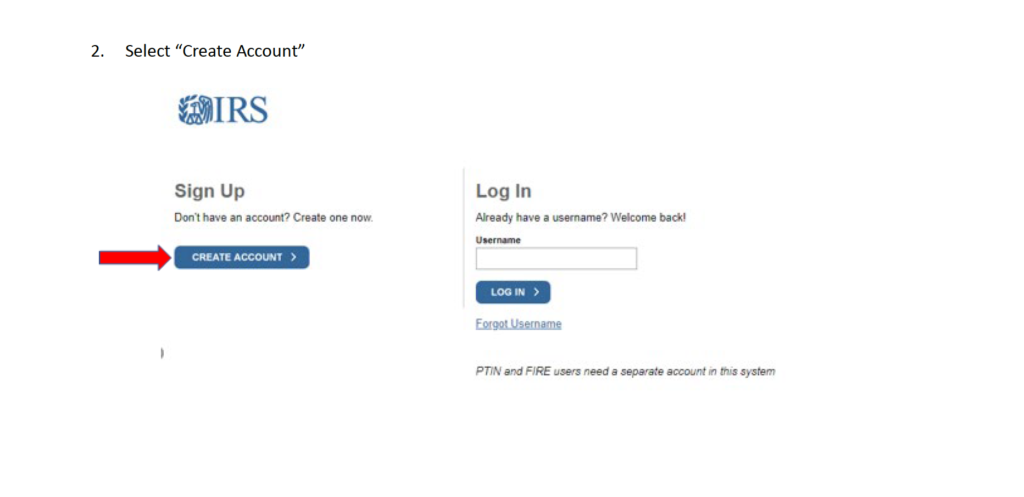

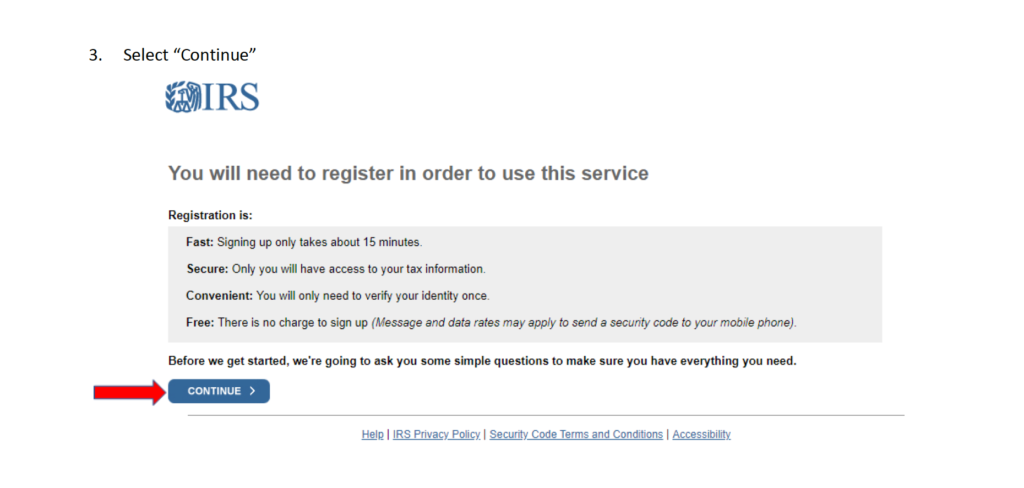

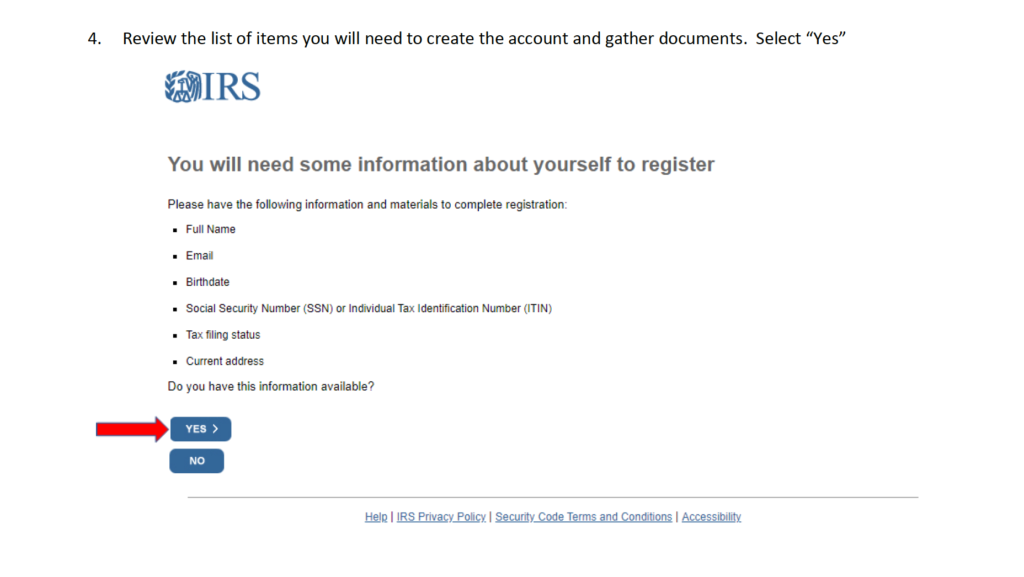

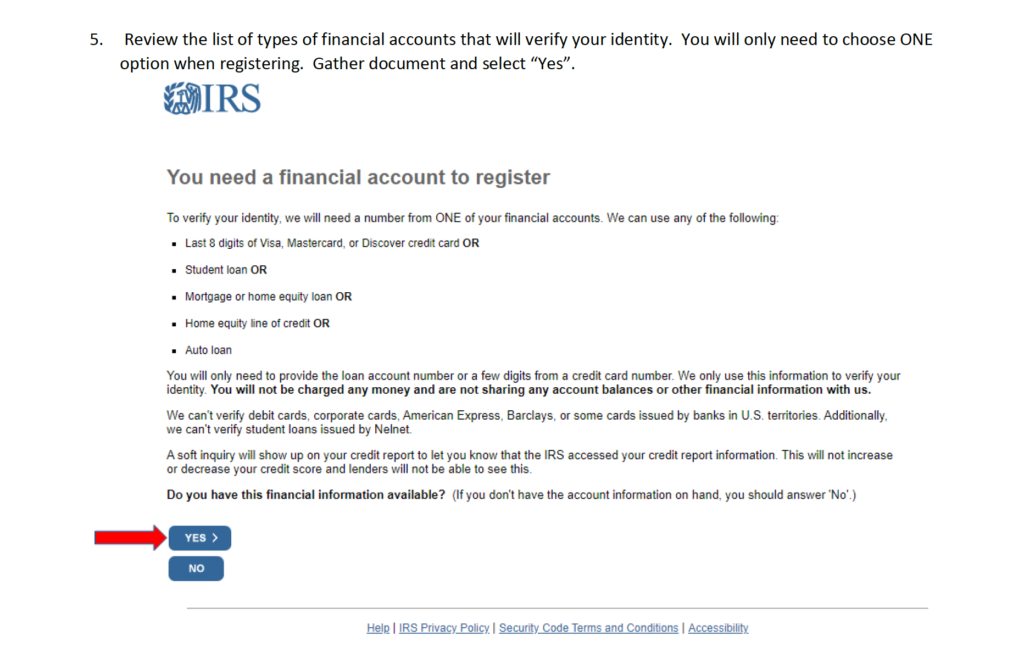

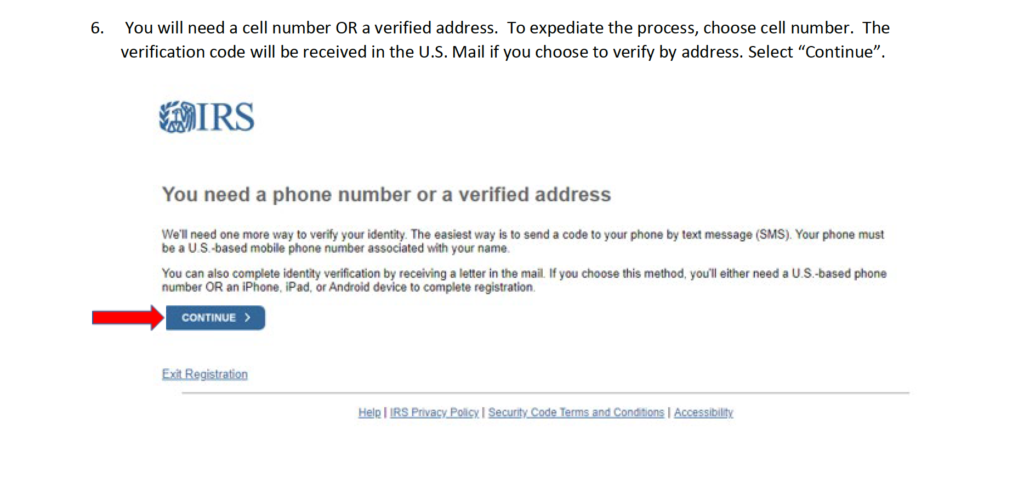

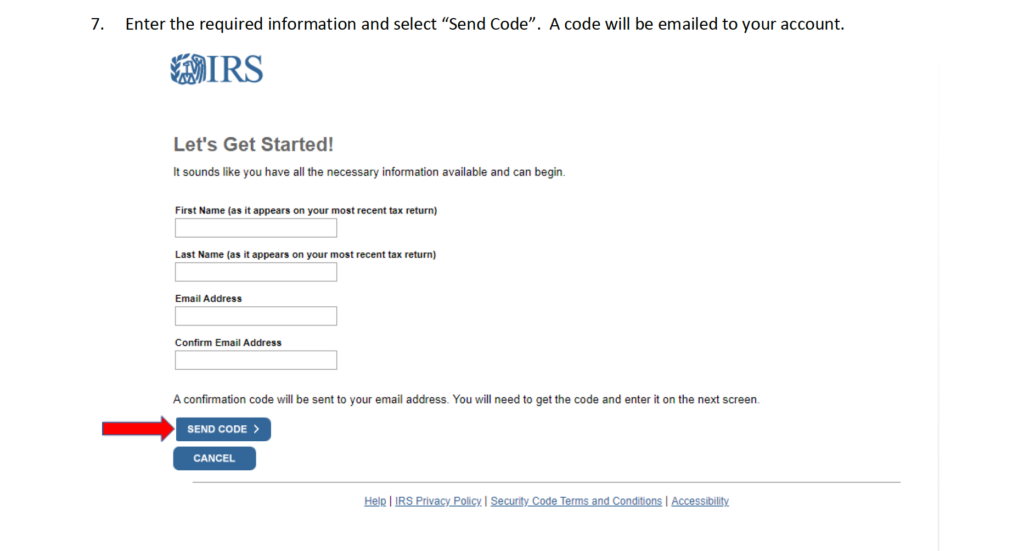

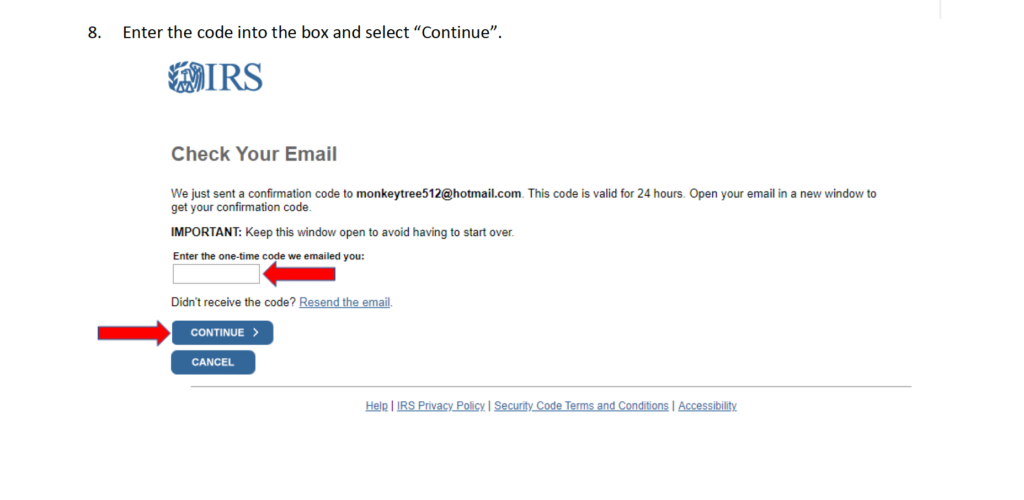

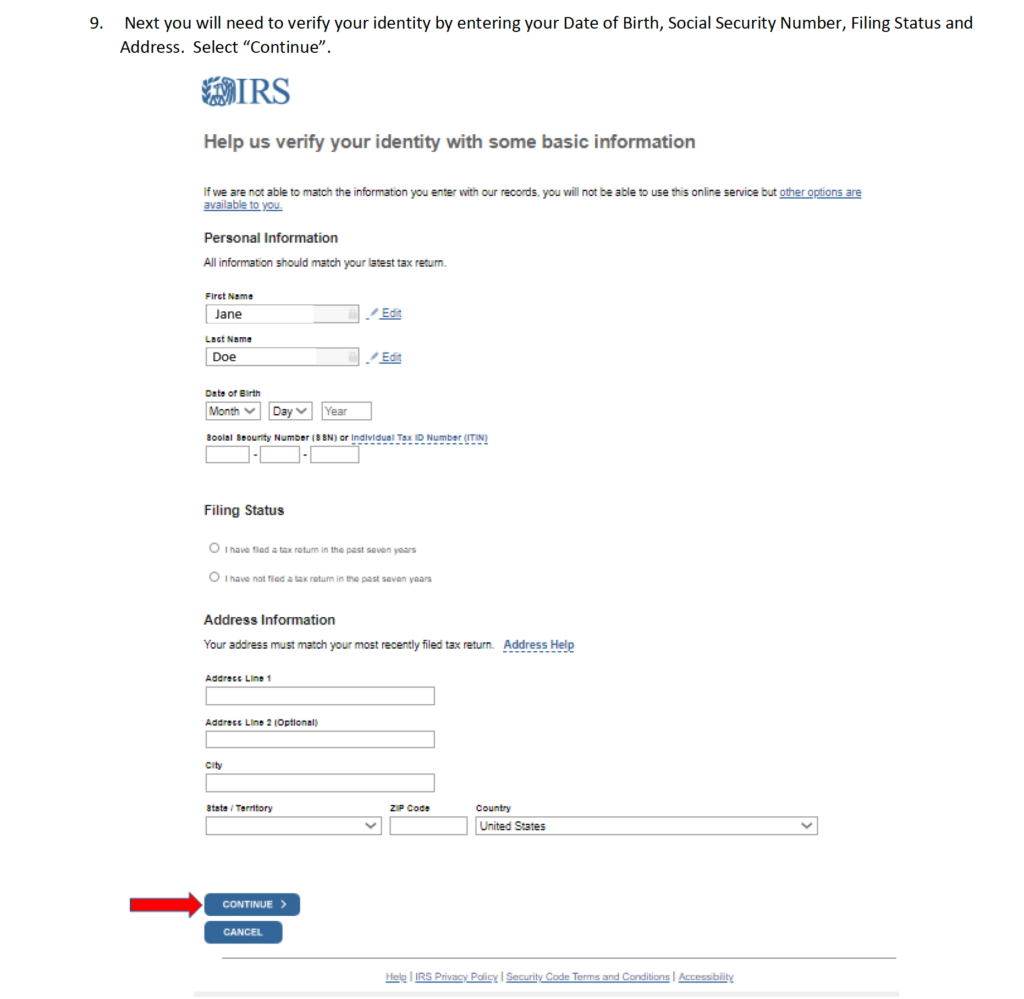

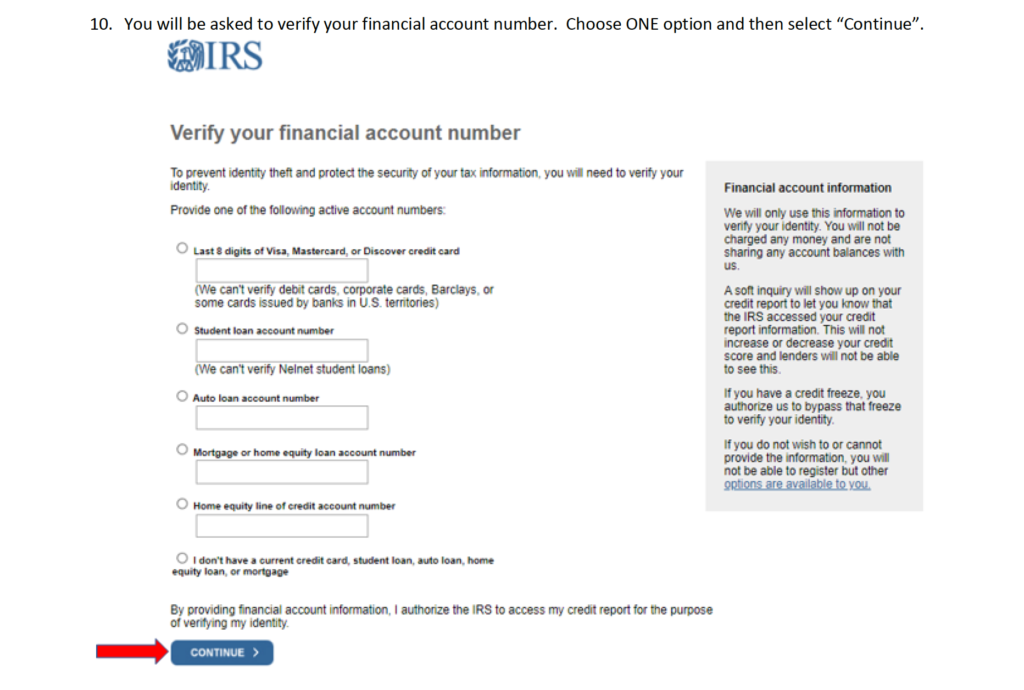

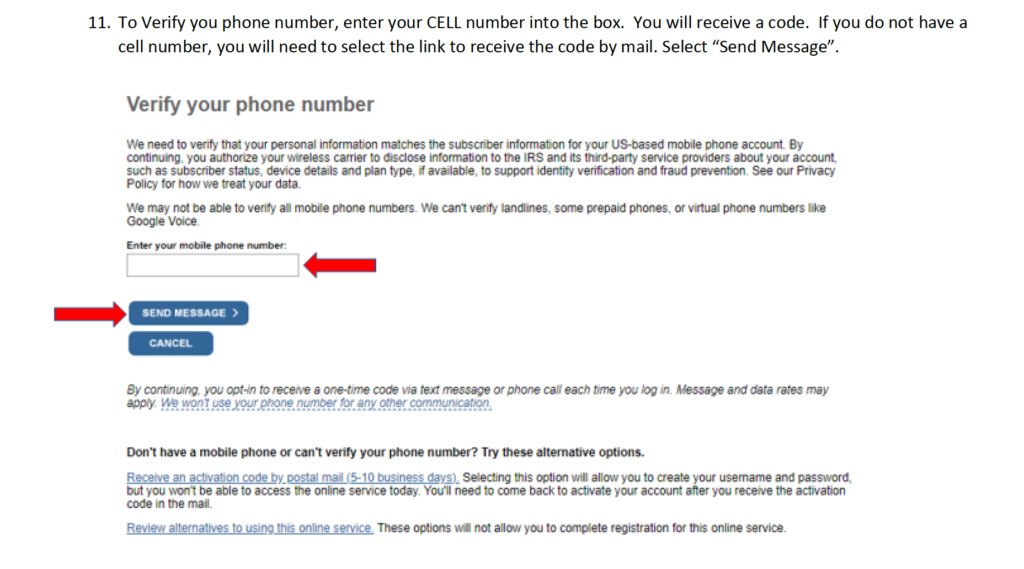

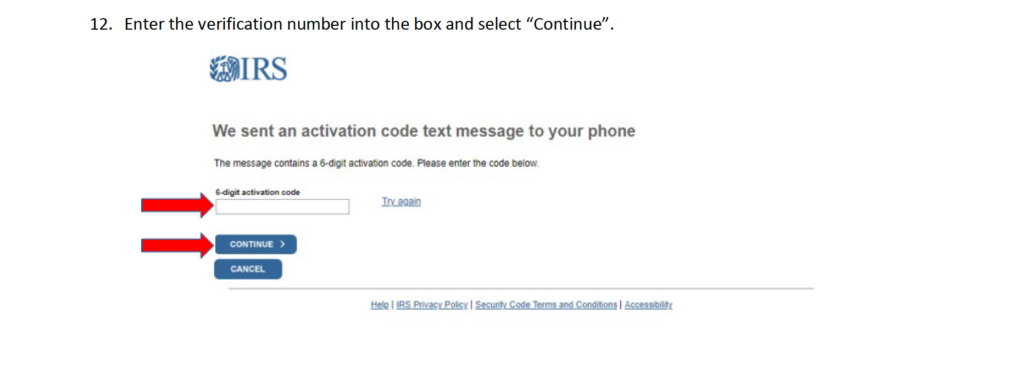

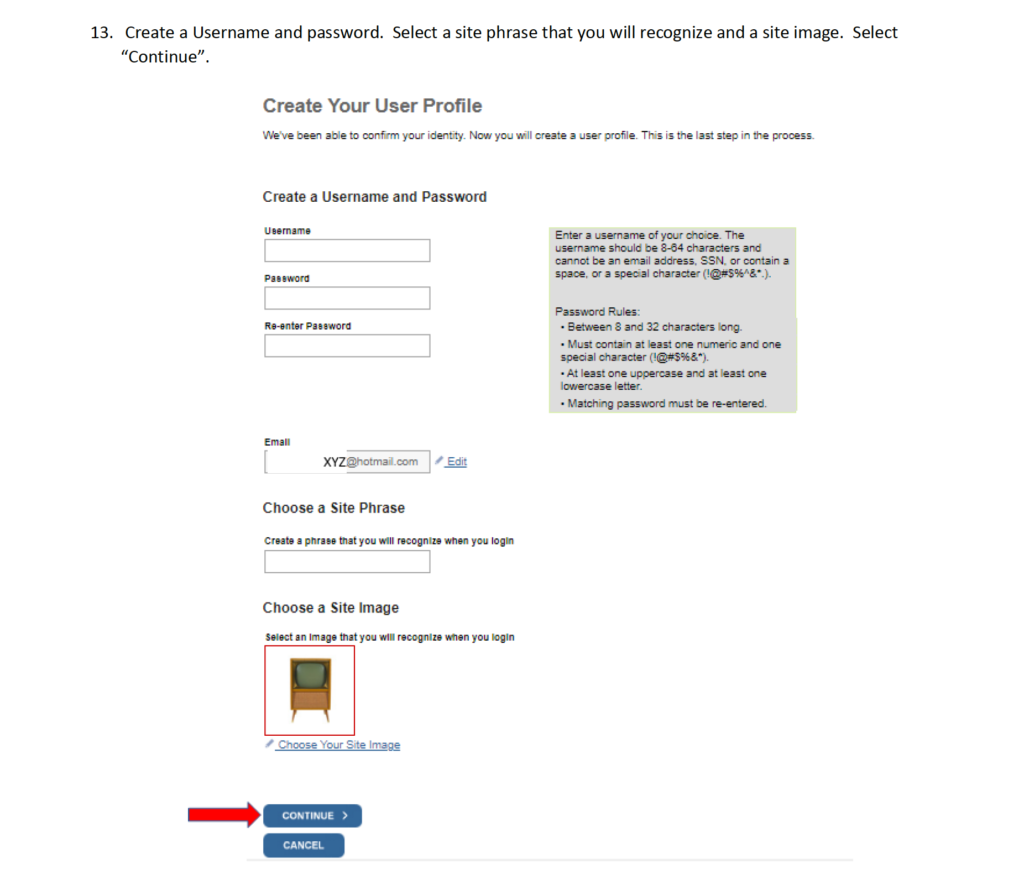

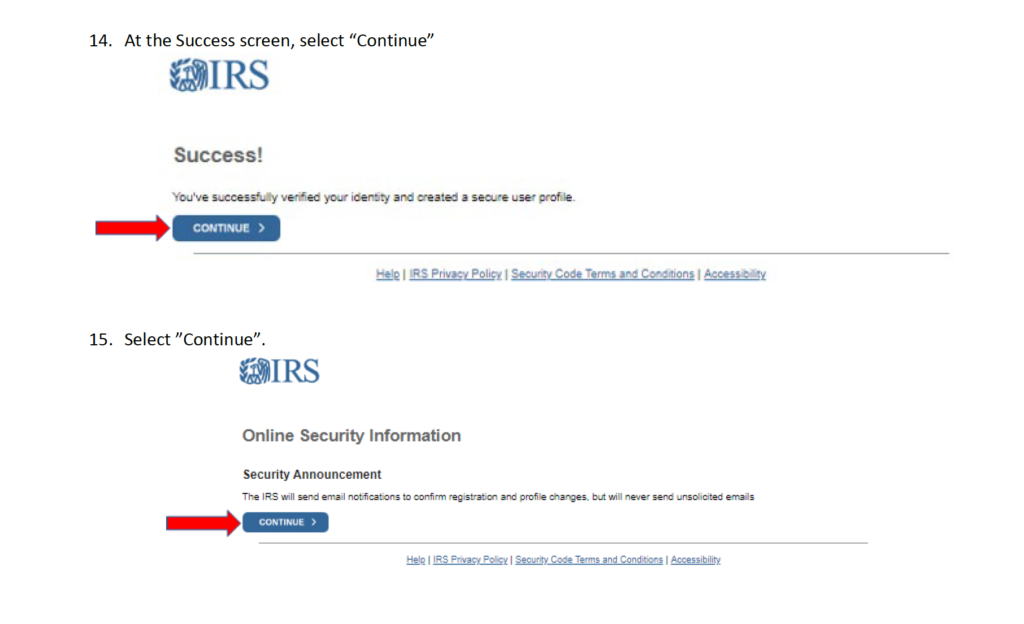

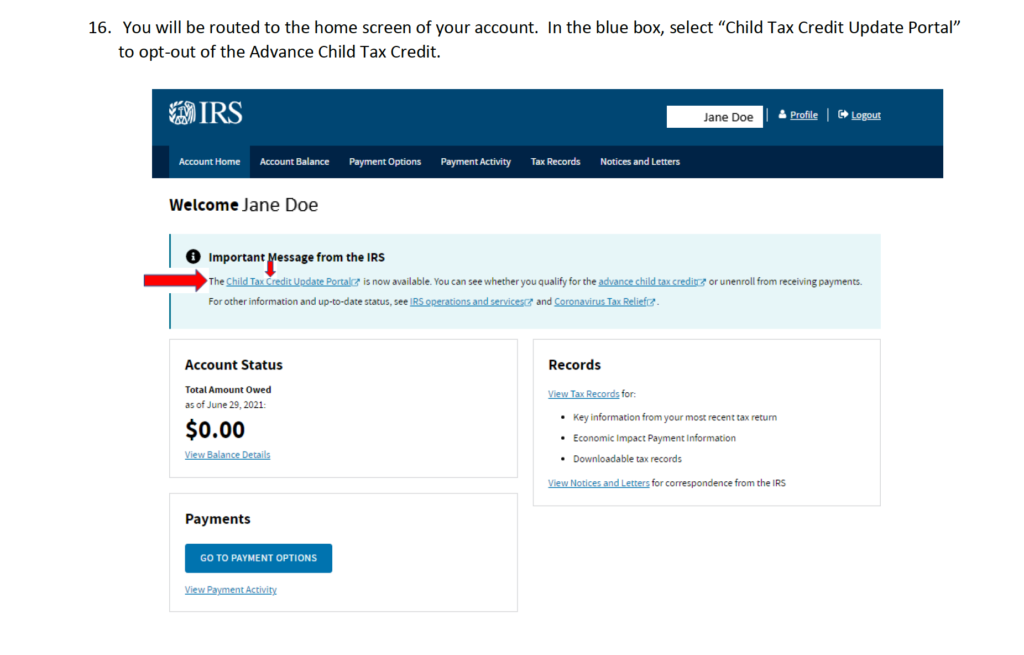

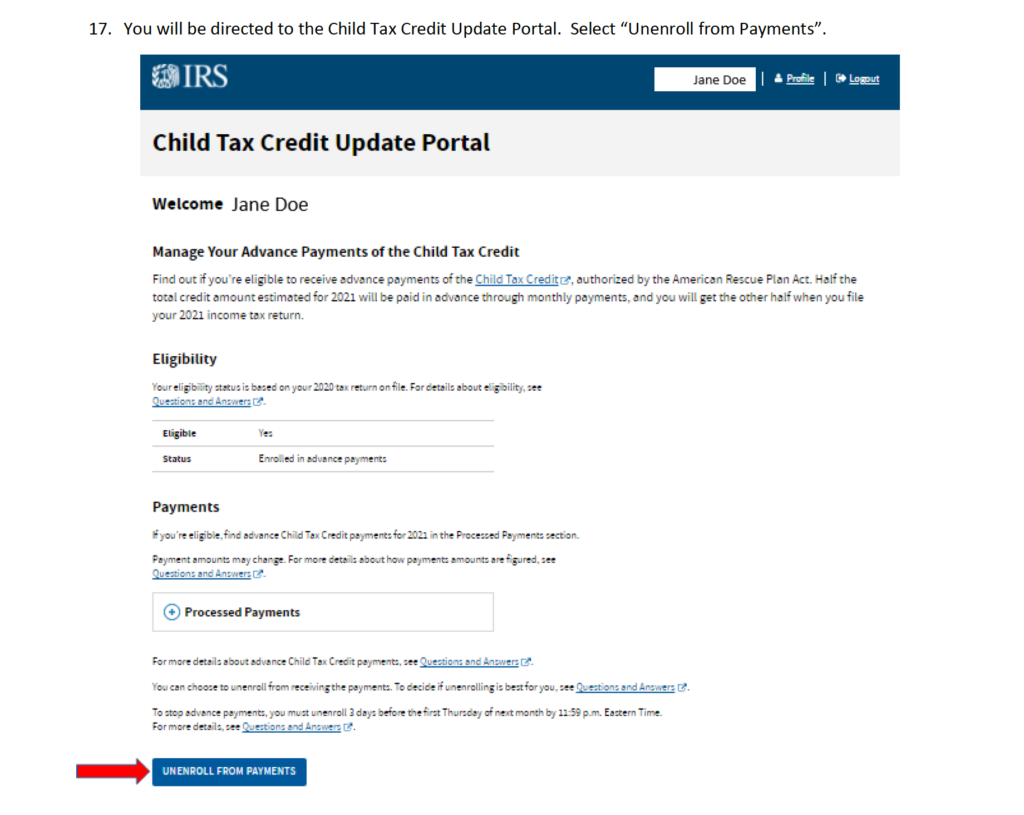

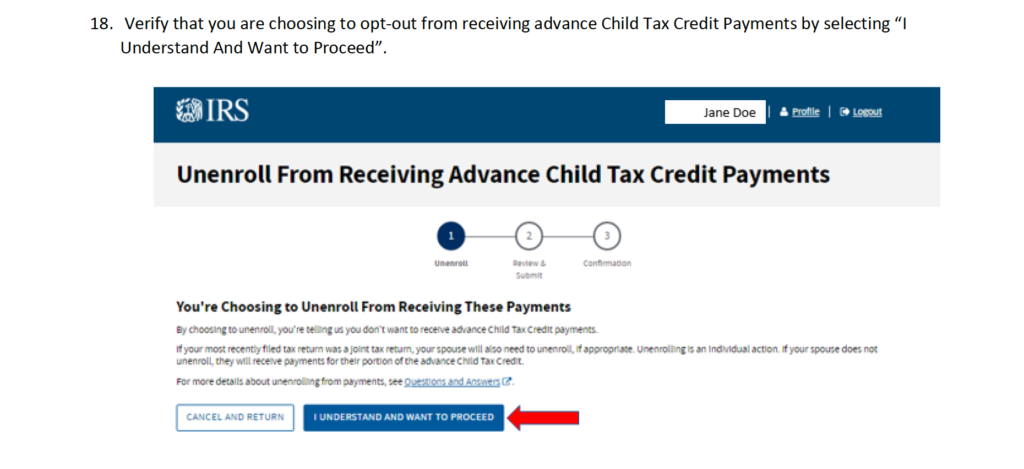

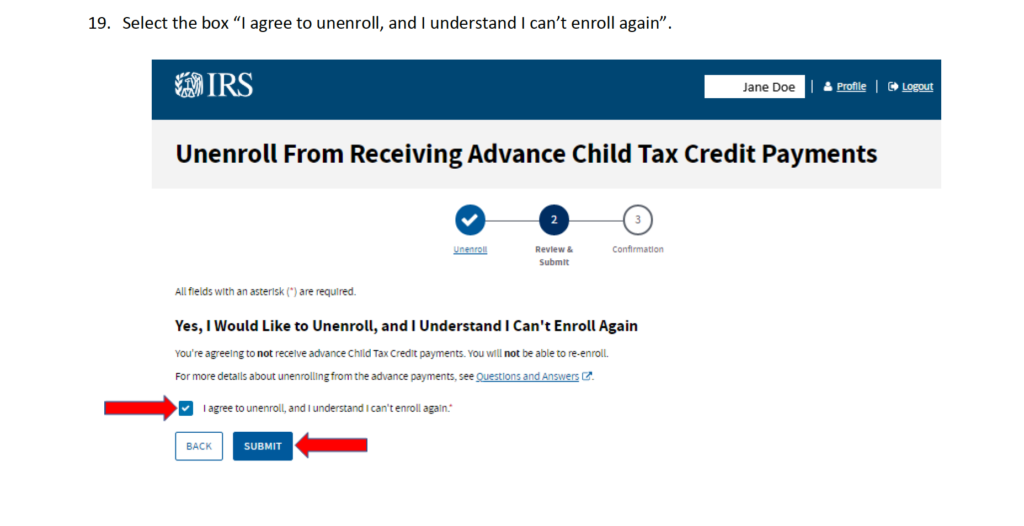

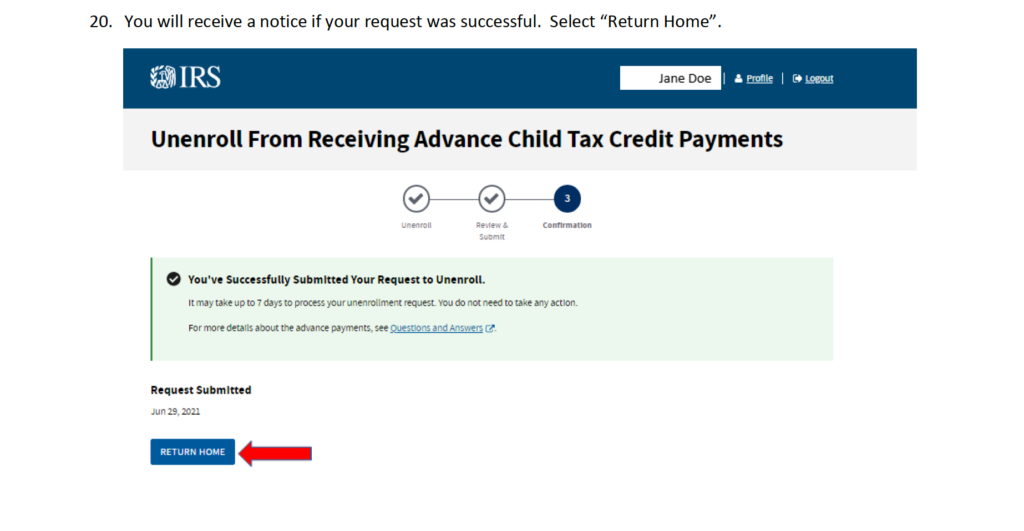

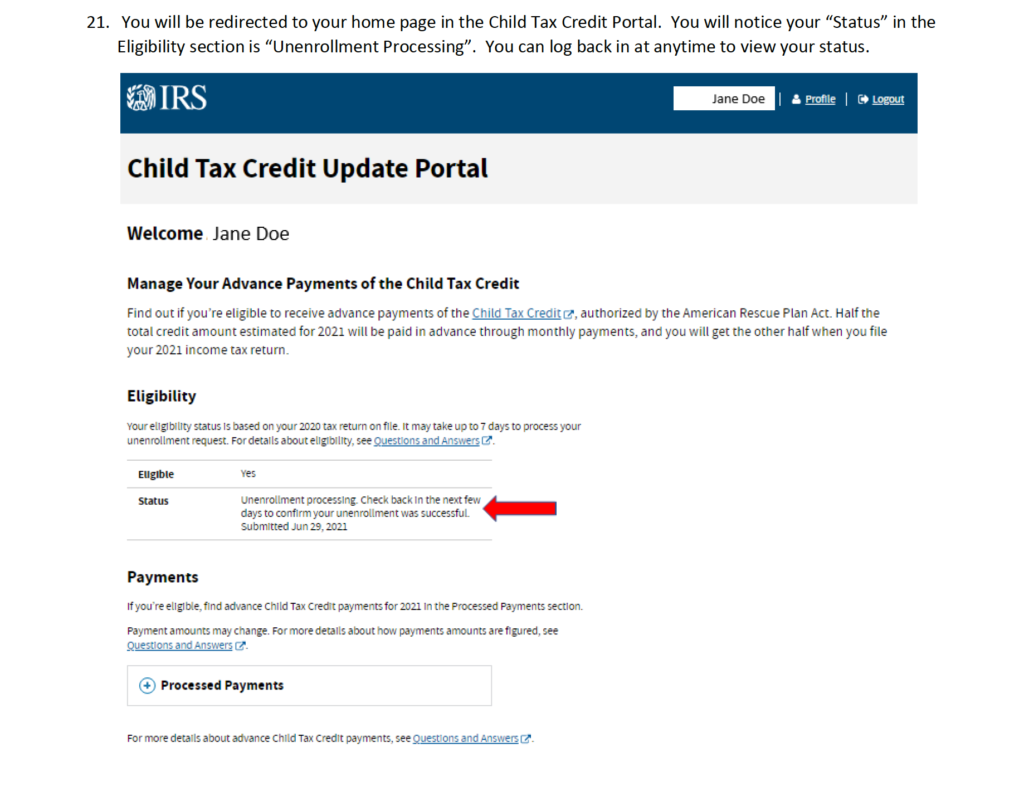

Here are the instructions if you go the route of creating an IRS.gov account prior to opting-out of the Child Tax Credit instead of creating the ID.me Account.

In our opinion, this should be the recommended process. The ID.me process is time-consuming and the site times out constantly. Here is a link to this entire process in a PDF IRS.gov Acct – Opt out of the Advance CTC

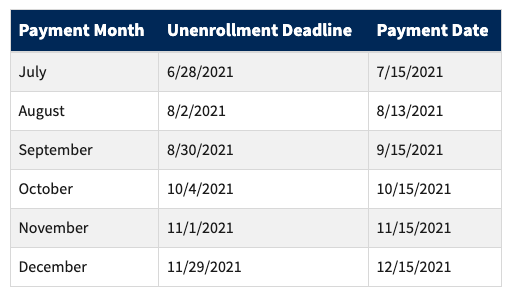

Deadlines to unenroll in the advanced child tax credit payments

Recent Posts